ct sports betting tax

So to be straightforward yes. The state has been a desirable market for many operators.

Gov Hochul New York S Mobile Sports Betting Brings In Record Tax Revenue Cbs New York

Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season.

. Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. However this study might take a while. The retail sportsbooks through the Connecticut Lottery added 88 million in handle and 827609 in revenue.

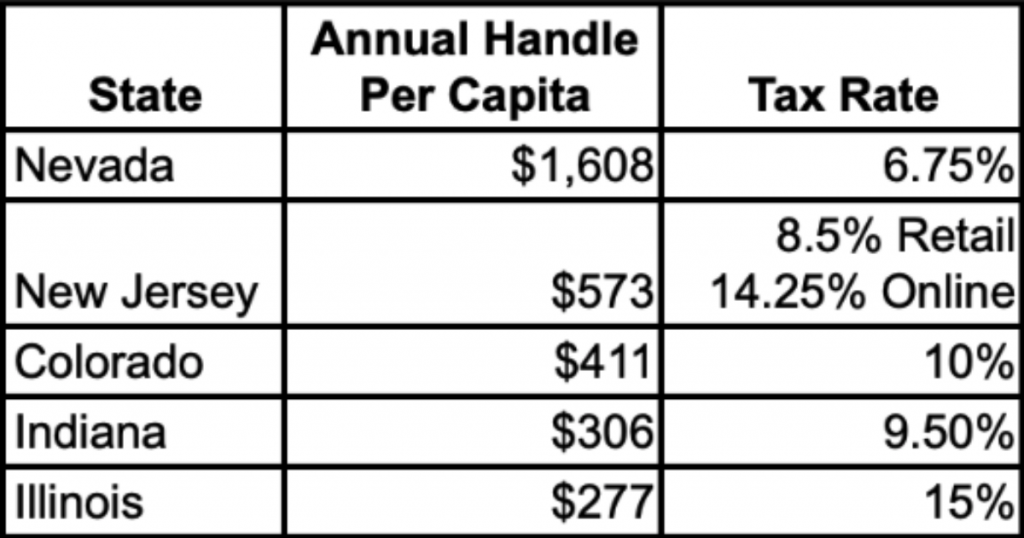

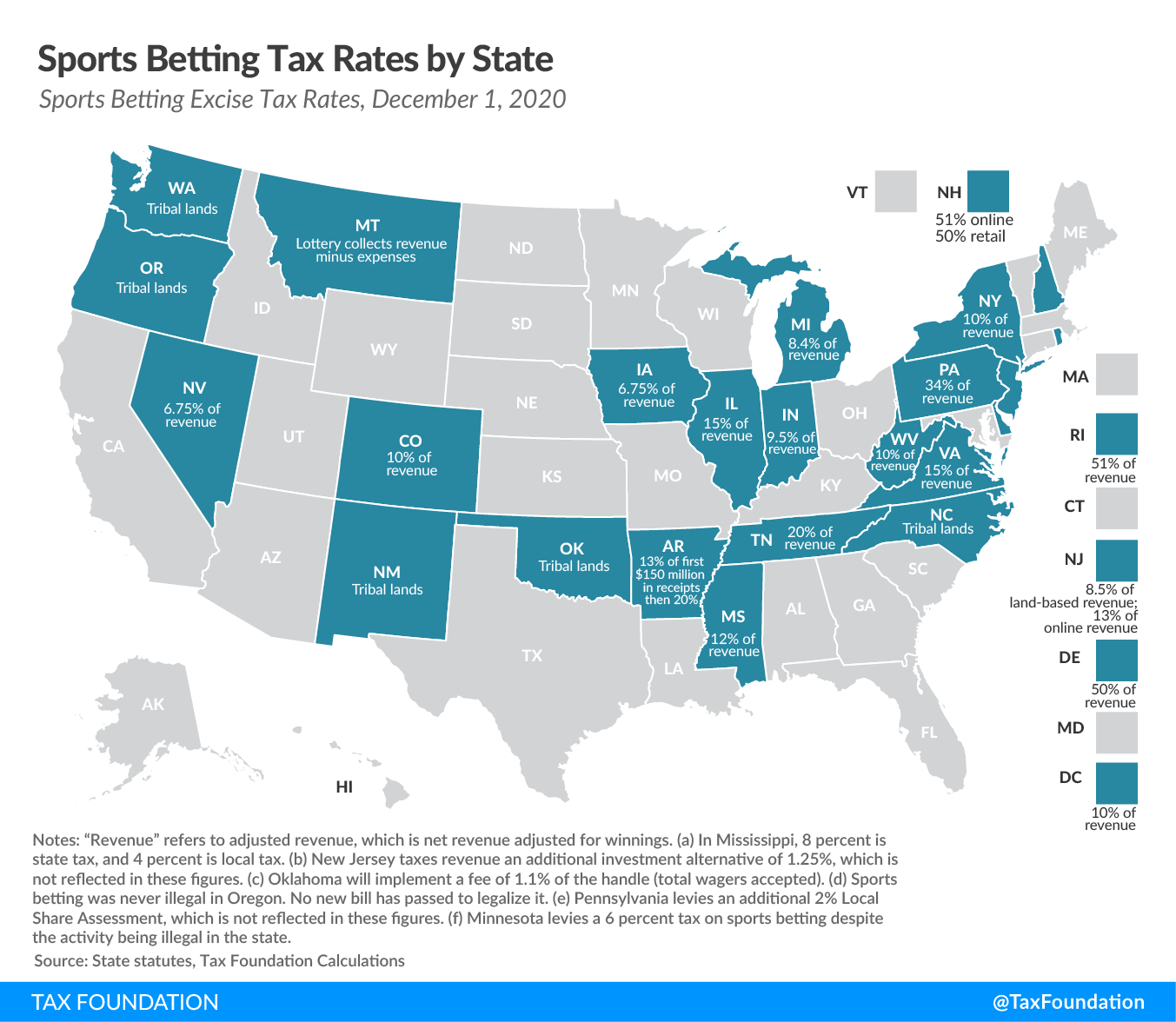

That led to more than 1 million total taxes paid for the month. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. It will likely help to bring Connecticut a huge amount of.

Many punters were wondering whether they need to pay liabilities on their profits from sports betting. 10 Free Play 300 Matched Bonus. This law applies to all CT Lottery.

The PlaySugarHouse Sportsbook service is operated by Rush Street Interactive CT RSI CT an affiliate of a US-based casino group Rush Street Gaming that owns and operates several leading land-based casinos in the US including the Des Plaines-located Rivers CasinoThe RSG group has been developing land-based casinos in North America since 1996 and fully understands the. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. A 1375 percent tax rate on sports wagering.

18 online 1375 retail. Football MLS fanatic. For more legal casino and sports betting news across the US follow us on twitter Gamble_usa for the latest news and offers.

In addition to this your gambling income will be subject to federal tax. Colorado Sports Betting Tax Rate. Connecticut has recently expanded its gambling market with the addition of iGaming and online sports betting.

The states tax coffers gained about 25 million from online casino gaming and about 17 million from sports betting last month on a total of 823 million in wagers. Connecticut Governor Includes new Tax Revenue in Budget Proposal. The deal also calls for a separate 1375 tax rate on sports betting.

Reportable for federal tax purposes OR. The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. Connecticut Lottery shall have the right to sublicense locations to the state-licensed parimutuel operator.

10 online 8 retail. The total amount owed for taxes on gambling winnings depends on the total amount earned by. The money that you gain by gambling which includes sports betting as well is subject to income tax.

If the winner is a part-year resident of Connecticut and meets the gross income test gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal adjusted gross income and to the extent the winnings were received during the Connecticut residency portion of the winners taxable year. This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to. Both sports betting and online gambling would be limited to those 21 and older.

All gambling winnings are subject to Connecticut income tax. With such a flourishing ecosystem everyone pro and anti-gamblers alike agree that a study will benefit the industry. Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in additional revenue for the state from all new forms of gambling.

State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. 13 of first 150 million then 20.

Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues. This season is expected to be the most-wagered-on one in history. Subject to federal withholding tax.

Thats good for an effective tax rate of 125 which matches the states bifurcated tax rates of. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting. And 1375 on sports betting and fantasy sports.

When sports betting will be legalized the tax is expected to be at 7 - 10 or similar to lottery winning that stands at 699. The state to operate an online sports betting skin through the Connecticut State Lottery. April 18 2022 Connecticuts three mobile sportsbooks combined for 1319 million in handle and 67 million in revenue during March.

How States Tax Sports Betting Winnings. Facilities are required to withhold 24 of your earnings for federal withholding tax. Connecticut state taxes for gambling.

Sports betting taxes apply even if you are wagering just for fun and not only to the professional bettors. 24 Tax Withheld. The state will collect taxes of 18 initially on online casino gambling increasing to 20 after five years.

If the winner is a resident of Connecticut and meets the gross income test all gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal adjusted gross income. The companies will also pay a 1375 percent tax on sports and fantasy sports betting. A 1375 tax rate on sports wagering and an.

If you manage to win money while betting in the Centennial State youll be expected to pay state betting tax. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident resident. Horse or dog races winning in Connecticut are subject to a 30 tax.

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

Draftkings Ceo Talks To Analysts About New York Sports Betting Taxes

Five Things To Know About Legalized Sports Betting In Connecticut The Connecticut Examiner

New York Sets Record For Sports Betting Tax Revenue At 267 Million

Information For Taxes Ct Playsugarhouse

Information For Taxes Ct Playsugarhouse

Live And On Tv Gambling Negotiations Go Public

Today Tip Is Available Now Inbox Me On Whatsapp 2347062491581 In 2022 Today Tips Books Online Tips

Greek Isles And Italy 2023 Em 2022

Mobile Sports Betting Operators May Not See Profits In New York State Crain S New York Business

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

Mass Senate Passes Sports Betting Bill

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

New York Sets Record For Sports Betting Tax Revenue At 267 Million

Sugar Snack And Soda Taxes Tax Foundation

Daytona Beach Fronton Jai Alai Program Book 1964 Tournament Of Champions 1829205310 Daytona Beach Tournaments Beach

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

Tennessee Collects 4 8m In Taxes On May Sports Wagering An Improvement Over Last Month State News Herald Net